|

Personal stories are one of the greatest advocacy tools, and everyone has them! They help people understand the real-life impact policy will have. They can motivate people to take action on an issue. Our friend and colleague Sarah Wrightsman, Executive Director of Workforce Housing Coalition for the Greater Seacoast, wrote this great blog on how effective your personal story can be.

READ HERE

1 Comment

I am writing today in support of Senator Bradley’s bill SB 15, (the Affordable Housing Fund), as it addresses the critical importance of public-private partnerships in order to make affordable housing a reality. Senate Bill 15 proposes a $10 million appropriation for state fiscal years 2020-21 into the Affordable Housing Fund. It also proposes an annual transfer of $5 million from the Real Estate Transfer Tax into the Fund.

The truth is that without a public- private partnership provided through the Affordable Housing Fund, affordable housing will not get built in the Mount Washington Valley, nor elsewhere in New Hampshire. This is due to the inherent costs of housing development including high property costs, infrastructure costs due to regulations, rising material expenses, and labor costs. Almost every state in our country, including red states and low tax states, has recognized that state housing trust funds play a critical role in financing and incentivizing the private market to serve a wider range of incomes. With the exception of New Hampshire, every other New England state has made major investments in their state housing trust funds, ranging from $37 million (Vermont) to $1 billion (Massachusetts). We are competing with our neighboring states for our workforce. The Affordable Housing Fund was created by the legislature in 1988 to facilitate the development of affordable housing. The Fund typically provides below market rate loans to developers in order to leverage the investment of other private and federal loan resources. According to the National Housing Trust Fund Project, 47 states and the District of Columbia have created housing trust funds to encourage the development of affordable housing. Most states have a dedicated funding source, (typically connected to real estate transactions), to capitalize the trust fund. To date, New Hampshire has had no dedicated funding source and investments have been relatively small. There is an affordable housing shortage in New Hampshire. The lack of affordable housing in our state is affecting workforce recruitment and retention. It is driving millennials and young families out of our state. It is increasing homelessness for working families. I urge us all to recognize that an unfettered market today will not serve every member of our community. In order to sustain vibrant local economies, we need an appropriate balance. The public-private partnership has proven effective for other states. Private market vigilance, tempered by public mission, will result in housing that is affordable for every-day working people. Senator Bradley’s Affordable Housing Fund bill embraces that balance. Let’s continue to move forward with a well-funded state housing trust fund. How I love the Mount Washington Valley! Growing up here and attending local schools prior to going off to college, I feel lucky to find myself back at home in this wonderful community, raising my family. Where as we have a natural playground that surrounds us everyday, living and working in MWV can present challenges to young families with regard to quality, affordable housing, and well-paying jobs.

If we wish to grow our local economy, we must undertake some common-sense actions to make New Hampshire more attractive to young workers and their families. The Mount Washington Valley and the rest of the state now face a real housing affordability crisis. Vacancy rates statewide are lower than 2%, and locally, closer to 1%. Housing costs have climbed to a point that it’s driving our workforce away. Consider this - NH’s housing wage (the hourly rate required for a worker to afford housing), is now over $21 an hour, ($21.71 to be exact), but the average renter in NH earn $14 an hour, and that wage is lower in MWV. To state the obvious, the math doesn’t work out. A large percentage of our workforce cannot afford to live in the MWV. For those who finding housing elsewhere, the average wage doesn’t provide much money to be spent in the MWV. If we wish to have a strong, healthy economy, workers need to have access to housing that they can afford. We will continue to lose our young families and workforce to neighboring states if we do not take the opportunity to act now. Homes serve as the hub of a very important wheel in our economy. In my conversations with many valley employers, they share that they are struggling to find and retain workers. Why? One of the top reasons recognized by most employers, is lack of available affordable housing. Our workforce is our community. Firefighters, law enforcement, teachers, hospitality workers, healthcare workers…..our community, unable to live close to their jobs because of the lack of an affordable place to live. We need housing that doesn’t take more that 30% of someone’s monthly income. Since 2010 the MWV has seen a 17.9% increase in rental rates for 2 bedroom apartments, while employment wages have increased by only 5 ½%. The vacancy rate for MWV 2 bedroom apartments is essentially 0% and the vacancy rate for other rentals hovers at about 1%. We do not have the available housing stock to bring young families and young workers to the valley. And with the tight rental market, rentals that are available are not affordable to our workforce. Many long term rentals have turned to Air B&B. Young families, who want to lay down their roots and become part of our community, are having difficulty finding homes or rentals that they can afford. By 2030 almost half of our community, our current workforce, will be over the age of 65. With lack of available housing, who is going to move here and fill those jobs? Our situation is not unique and many communities across the state are in the same situation. This problem cannot be fixed overnight. MWVHC works very hard to advocate at the local and state levels to promote housing legislation that is part of the solution. We work with planning boards to look at their zoning and land use regulations to help make communities more housing friendly. We need your help. Learn more about us. Engage your local and state officials. Discuss, educate, advocate and support. Sincerely, Victoria You may be wondering about the tie-in between short-term vacation rentals and affordable/workforce housing. In a four season vacation destination like the Mt. Washington Valley, the decisions made by property owners with space to rent could have a major impact on affordable housing. For example, do home owers rent the new accessory dwelling unit they just built to someone in the local workforce for a reasonable monthly rent...or do they gamble on making a month's rent in one week, by renting it to vacationers? Driven, in part, by pressure from the lodging industry, New Hampshire's legislature is taking another look at taxing AirBnB rentals. Here is a link to a recent article in NH Business Magazine on the subject: Airbnb Tax What do you think? Tax or no tax... and should some measures be taken to help preserve rental units for the affordable housing market? Is so, what?  We've written a lot about Accessory Dwelling Units and the progress of SB 146 through the New Hampshire Legislature, so it will come as no surprise that the Governor has signed the bill into law. It will go into effect in June of 2017. With that in mind, I'm posting a link to a very informative webpage on ADUs, done by PlanNH's Vibrant Villages initiative. The page contains a wealth of information on ADUs, including discussions on zoning. If you have an interest in ADU's, this is a great resource!. With the help of sponsors, grantors and partners, the MWVHC put on a very successful design charrette in 2013. I’ve heard about this event since I started working here but I'll admit to being somewhat ignorant about the charrette process and the goals..

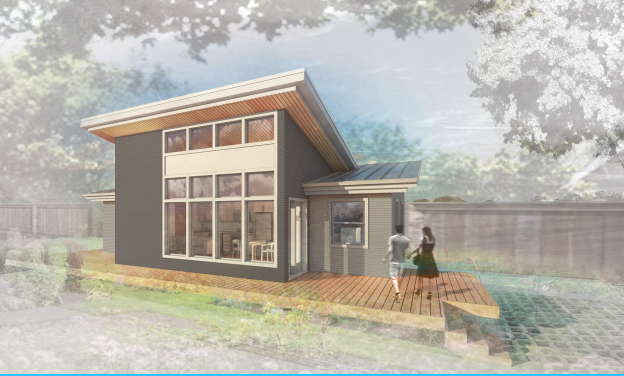

With that in mind, I did a bit of research…. which is particularly important now, since we are in the midst of planning another charrette for later this year. More on that as we get closer to the dates. In the meantime, here is some of what I found out about charrettes. A charrette is an intensive planning session where citizens, designers and others collaborate on a vision for development. It provides a forum for ideas and offers the unique advantage of giving immediate feedback to the designers. More importantly, it allows everyone who participates to be a mutual author of the plan. http://www.tndtownpaper.com/what_is_charrette.htm For the MWVHC and its partners, that will translate into providing an opportunity for planners and housing specialists to work together in teams, visualizing and testing development ideas relating to the theme of our next charrette: Re-Use, Rehab & Revitalization for Affordable Housing in the MWV. It sounds exciting, challenging and potentially rewarding for the participants and the community-at-large. A link to a excellent video by the National Charrette Institute on their NCI System is below. Though we won’t be using their system, there are many similarities in the process. Additionally, we'll be sure to keep everyone updated on the charrette we are planning for later this year. Look for information on our Facebook & twitter pages. NCI Video Link Research clearly demonstrates a positive correlation between the availability of affordable housing and lowering healthcare costs. The following is excerpted from: How Investing in Housing Can Save on Health Care by Lisa Sturtevant, Ph.D., Janet Viveiros Having access to safe, stable and affordable housing can lead to better physical and mental health and improve overall quality of life in a variety of ways. When families have access to affordable housing, they can spend more on food and health care, which can lead to better health outcomes. Housing in neighborhoods of opportunity can lead to less stress and social isolation and better physical health outcomes, including lower rates of obesity. A safe and secure place to live can help homeless individuals with chronic health conditions access medical care, maintain good health regimens, and experience better physical and mental health. Because of these links between housing and health, investment in housing and resident services can potentially result in a net public savings if spending on public health-related services is reduced. In Seattle, a Housing First program resulted in health cost savings of $42,964 annually while the cost of providing housing and services was just $13, 440. You can read the full report here: Accessory Dwelling Units (ADUs) are a hot topic right now...and with good reason. ADUs can be one of the most cost effective and environmentally friendly ways for communities to expand their availability of affordable housing. So, what exactly is an ADU? The folks at Accessory Dwelling, an Oregon organization which helps people interested in ADUs, can explain that much better than I can: An accessory dwelling unit is a really simple and old idea: having a second small dwelling right on the same grounds (or attached to) your regular single-family house, such as:

Regardless of its physical form (backyard cottage, basement apartment, etc.), legally an ADU is part of the same property as the main home. It cannot be bought or sold separately, as a condominium or a dwelling on wheels might be. The owner of the ADU is the owner of the main home. Flexibility in housing makes sense for environmental, lifestyle, and financial reasons. Though many people buy houses and live in them for decades, their actual needs change over time. But the way that houses are currently built doesn’t reflect those changes, especially the way households may spend decades with just 1 or 2 members. Many American houses are too big for 1- or 2-person households, which is too bad, because size is probably the biggest single factor in the environmental impact of a house. If you have a reasonably sized house, and an even more reasonably sized ADU, you’ve likely got a pretty green combination with some social benefits as well. You could have your best friend, your mother, or your grown kid, live with you. This kind of flexibility and informal support could really help as the nation’s population ages. Most people want to stay in their homes as they age, but finances and design can be problematic. An ADU could help aging people meet their needs without moving. Additionally, ADUs create affordable housing, but not in the usual institutional way. The affordable housing ADUs create is unlike the product of the (subsidized) affordable housing industry. It is totally voluntary and un-guaranteed. For these reasons ADUs can never be the entire solution to the affordable housing challenge. On the other hand, ADUs are extremely economical to construct per unit, cost the government little or nothing to allow, and — given the number of single family residences in US cities — could be incredibly abundant. Perhaps best of all, ADUs are individualistic and creative. All impressions are that they add, in a small way, to family and neighborhood connections. They could be the opposite of boring gentrification — they might actually help make a place interesting enough to live in. HERE IS A WONDERFUL LITTLE VIDEO FROM ACCESSORY DWELLING.ORG ON ADUs. When it all said and done, the MWVHC thinks ADUs are a pretty great thing. In that regard, there is a bill currently in the New Hampshire legislature (Senate Bill146) concerning ADUs. The bills enjoys bipartisan support, has been passed by the NH Senate and is due for a House vote in early January. The Mount Washington Valley Housing Coalition joins many other organizations in strongly supporting the passage of SB146.

As written and amended, the bill addresses the growing need our state has to provide affordable housing opportunities for its citizens. In brief, the bill:

As outlined here, ADUs can represent a low cost, long-term way to help stem the rising tide of New Hampshire’s inadequate supply of affordable dwellings and workforce housing. ADUs:

Last year, the New Hampshire Housing Finance Authority commissioned a detailed, three-part study to examine factors that will influence New Hampshire’s future housing needs. The study was conducted by the New Hampshire Center for Public Policy Studies and Applied Economic Research. The resulting report recognized a serious gap between our existing housing stock and the needs and desires of our citizens. Passage of SB 146 represents a significant step toward addressing that mismatch and, at the same time, increasing our much needed supply of affordable housing. For all these reasons, we strongly urge you to support passage of Senate Bill 146.

|

Proudly powered by Weebly

RSS Feed

RSS Feed